Optimal Asset Class for Each Fed Policy Regime

The Federal Reserve's decisions regarding the Fed Funds rate can significantly impact asset performance, making it a crucial consideration for investors. Changes in monetary policy can trigger market condition shifts that affect the value of stocks, bonds, precious metals, and other investments. Some periods may be more beneficial for riskier assets, while others may be more favorable for defensive ones. In this article, we will explore how different periods of the Fed Funds rate have affected the performance of various asset classes and compare their performance during those periods. Our analysis covers the period from 1982 to the present, encompassing several monetary cycles and recessions.

It's important to note that the Federal Reserve's policy and tools have not remained static over time; they have continuously evolved in response to changing economic conditions and new challenges. In the 1980s, the Fed shifted its focus to controlling inflation, which had been a persistent problem in the US economy since the 1970s. In the mid-1990s, the Fed began announcing the target for the federal funds rate decided at FOMC meetings, and in 1999, it started announcing the FOMC's decision about the "bias" toward which direction monetary policy was likely to go. These changes may have altered the behavior of asset classes during the shifts in monetary policy, but presumably, the overall pattern still holds.

For the purposes of this article, we categorize Long-term Treasury Bonds and Gold as defensive assets and use the Wilshire 5000 as a proxy for the stock market. The entire time series is divided into distinct periods of declining, rising and unchanged (flat) interest rates. Flat periods are then divided based on the most recent Fed Policy to avoid producing smoother and less informative results. Single rate changes within an extended flat interval are considered periods of unchanged rates.

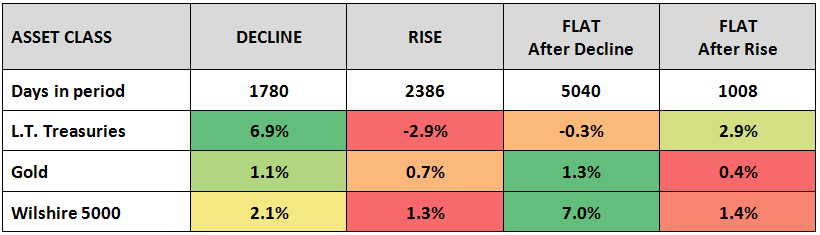

The table below displays the compound annual growth rate (CAGR) of the asset classes depending on the changes in the Fed Funds rate for the period 1982-2023.

From the table above we can derive the following conclusions regarding the stages of the monetary cycle:

- Declining interest rates is the most favorable time for Treasuries, with Gold and Stocks performing moderately well.

- Rising interest rates are detrimental for Treasuries, as demonstrated during the recent tightening cycle, with Gold and Stocks also experiencing their worst performance in this environment. Low nominal returns may result in even lower actual returns, which may not justify the risk of holding these assets. In such circumstances, holding cash could be the most optimal option for investors.

- Flat after a period of declining rates is the best time for Stocks and Gold, with Treasuries exhibiting their second-worst performance.

- Flat after a period of rising rates is the second-best for Treasuries, worst time for Gold and the second-worst period for Stocks.

Notably, the periods of Flat after Rise are, on average, three times shorter than the periods of Flat after Decline, suggesting that the tight monetary policy is not as sustainable in the long run.

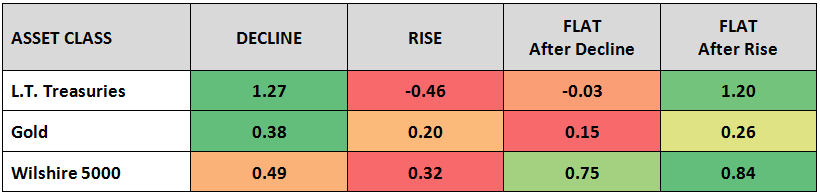

The table below compares the Sharpe ratio of the asset classes depending on the changes in the Fed Funds rate for the period 1982-2023.

The Sharpe ratio provides a more comprehensive approach to evaluating asset performance, taking into account not just the average return but also the asset's volatility. Upon analyzing both CAGR and Sharpe ratio, most of our previous conclusions remain valid, with a few additional observations worth noting.

- Treasuries exhibit the strongest performance during periods of Declining rates and Flat After Rise. Rising rates are detrimental period for Treasuries and Flat After Decline is their second-worst.

- Gold benefits from declining rates and is the only asset class that holds up moderately well during a rise in interest rates.

- Stocks offer the best risk-adjusted returns during any flat period, while both declining and rising interest rates seem to negatively impact stock performance. The highest Sharpe ratio during the Flat After Rise period, coupled with a relatively small CAGR, suggests that this period is characterized by reduced volatility of returns.

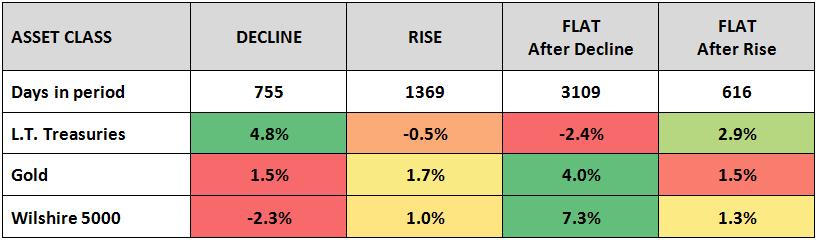

Since the Fed policy and tools are continuously evolving and becoming increasingly transparent through forward guidance, analyzing the most recent periods may provide additional insights into asset behavior. The table below displays CAGR of the same asset classes for the period 2000-2023.

From the table above, we can observe that generally, all of the previous conclusions still hold true, with one key difference: during periods of declining interest rates, stock performance becomes the worst. This can be explained by the fact that the Fed has become more focused on the stock market, and easing monetary policies have been implemented in response to rapidly deteriorating financial markets. However, it's important to note that this period includes only three recessions, thus reducing its statistical significance.

In conclusion, it would be reasonable to note that adjusting portfolio allocations and employing asset rotation strategies based on the prevailing monetary environment could potentially enhance the overall risk-return profile of an investment portfolio. By considering the impact of the Fed's policy and tools on various asset classes, investors may be better equipped to make informed decisions about their investments.